Your plan for drawing down retirement assets could be just as important as your approach to accumulating retirement savings. Experts recommend various methods, such as the so-called 4% rule — withdrawing 4% of your nest egg each year (with adjustments for inflation) — or a three-phase system dividing your assets into groups for short-term, mid-term, and long-term retirement needs.

Before you make any final decisions, it would be wise to consider the tax consequences of your withdrawal strategy.

This could be especially tricky if you have multiple accounts subject to different tax treatments. Among the questions you might ask are: (1) Do you want to pay taxes now or later? (2) Should you keep certain funds pursuing growth as long as possible? (3) Could taxable distributions push you into a higher tax bracket or affect the taxability of your Social Security benefits?Here are some guidelines on the tax implications of various types of accounts.

Taxable accounts such as savings accounts, certificates of deposit (CDs), and investment accounts offer no special tax benefit for keeping funds in the account. Although interest and dividends are taxed annually, withdrawals are typically not subject to ordinary income taxes. However, if you sell appreciated assets such as stock, they may be subject to capital gains taxes, which are generally lower than ordinary income tax rates but could still have a significant impact on your tax liability. There may be fees for certain withdrawals, such as early withdrawals from a CD.

Nonqualified annuities — annuities that are not held in an IRA or a qualified plan such as a 401(k) — are generally purchased with after-tax money. As such, only the earnings portion of annuity withdrawals is taxed as ordinary income. There are two ways to take money out of a nonqualified annuity — regular withdrawals and annuitized payouts. Regular withdrawals are taxed as earnings first, principal second (unless the contract was issued before August 14, 1982). With an annuitized contract, the earnings portion of each payout is taxed as ordinary income.

Tax-deferred retirement accounts such as traditional IRAs and 401(k) plans continue to accumulate tax deferred, even if you are no longer contributing to them. Because withdrawals are fully taxable as ordinary income, you might want to extend their potential for growth and defer taxes until later in retirement. Keep in mind that you must begin taking required minimum distributions (RMDs) from tax-deferred accounts when you reach age 72 (70½ if born before July 1, 1949). Once you reach RMD age, you might think of your RMDs as a “baseline” for income from your investment accounts and then look at the potential tax consequences of taking additional withdrawals from that account or other accounts.

Roth accounts include Roth IRAs and Roth 401(k)s. Qualified Roth distributions are not subject to federal income tax, and original owners of Roth IRAs are not subject to RMDs. [Roth 401(k)s are subject to RMDs, and inherited retirement accounts have different distribution rules.] To be considered “qualified,” a distribution must meet a five-year holding requirement and take place after age 59½, with certain exceptions. Because distributions are tax-free and don’t affect your income tax liability, you might decide to take Roth distributions early or later in retirement, depending on your tax situation. In either case, a Roth account provides flexibility to take withdrawals when you want or need them, or to keep funds pursuing growth for later withdrawals and/or to leave a legacy for your heirs.

Getting Help

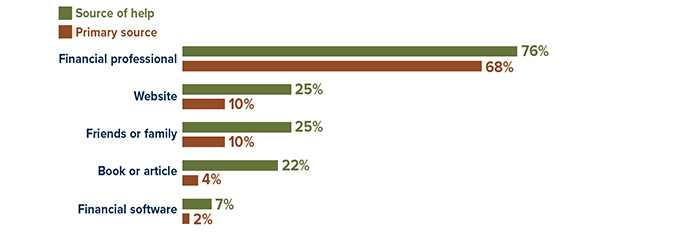

Almost seven out of 10 owners of traditional IRAs say they have a strategy for managing income and assets in retirement. Most of them get help from a financial professional.

Percentage of traditional IRA–owning households who have a strategy

Although there is no assurance that working with a financial professional will improve investment results, a professional can evaluate your objectives and available resources and help you consider appropriate long-term financial strategies.

Source: Investment Company Institute, 2021 (2020 data; multiple responses allowed)

Early distributions from all tax-advantaged plans prior to age 59½ may be subject to a 10% federal income tax penalty, although there are some exceptions. Annuities generally have contract limitations, fees, and sales charges, which may include mortality and expense charges, investment management fees, administrative fees, holding periods, termination provisions, charges for optional benefits, and surrender charges (during the early years of the contract). Any annuity guarantees are contingent on the financial strength and claims-paying ability of the issuing insurance company. The FDIC insures CDs and bank savings accounts, which generally provide a fixed rate of return, up to $250,000 per depositor, per insured institution. All investments are subject to market fluctuation, risk, and loss of principal. When sold, investments may be worth more or less than their original cost.

A sound distribution strategy could help stretch the longevity of a portfolio over time. Be sure to consult a tax professional before taking any action that might have tax consequences.

Reposted from marktoney.com

No comments:

Post a Comment